Home > Financial Tips > Avoid Fraud

Avoid Finanial Fraud

Beware of common financial frauds, including phishing scams, IRS and tax deceptions, and grandchild impersonation with these essential tips to help you recognize and avoid I.D. theft and financial losses.

Protecting Yourself: Common Financial Frauds and How to Avoid Them

In today’s fast-paced digital world, financial fraud has become increasingly prevalent. At Community First Credit Union, we prioritize your financial safety and want to equip you with the knowledge to recognize and avoid common scams. Here’s a rundown of some prevalent financial frauds and practical steps you can take to protect yourself.

If it seems suspicious or to good to be true, it might be!

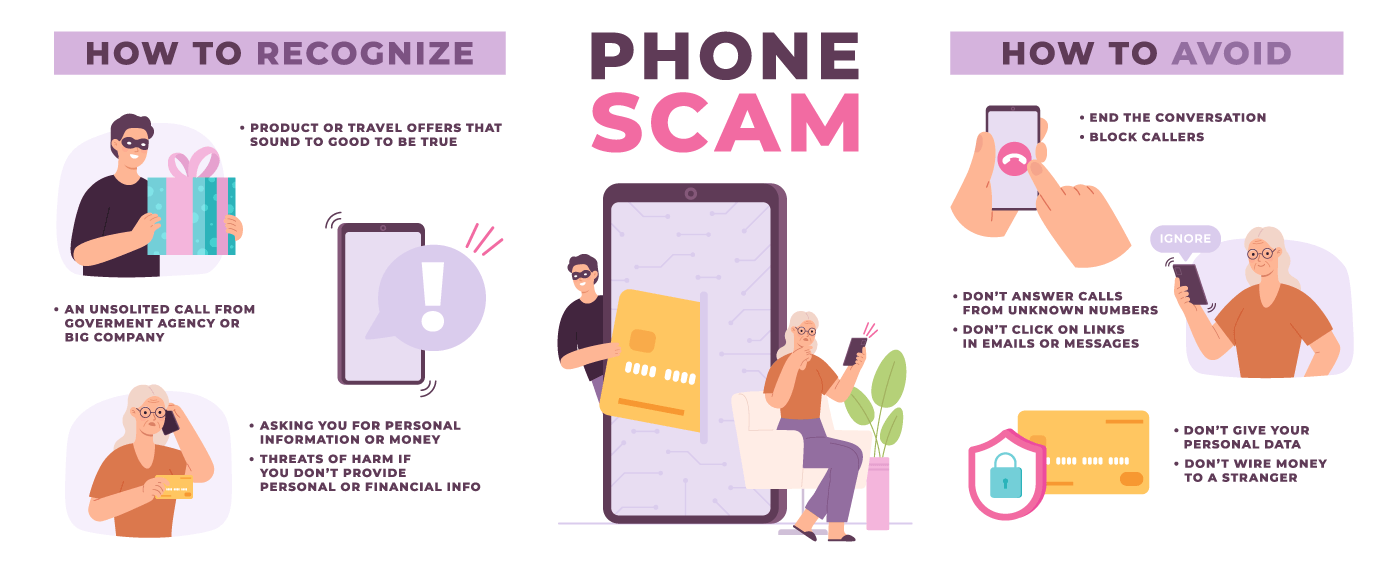

1. Phishing Scams

What It Is: Phishing scams often occur via email, text messages, or phone calls. Scammers impersonate reputable organizations, including banks or credit unions, to steal your personal information.

How to Avoid It:

- Verify the Source: Always double-check the sender’s email address or phone number. If it looks suspicious, don’t engage.

- Don’t Click Links: Instead of clicking links in messages, go directly to the institution’s website by typing the URL into your browser.

- Report Suspicious Activity: If you receive a questionable communication, report it to your credit union immediately.

Important Reminder: Community First Credit Union will never contact you to ask for your account number or other sensitive personal information. If you receive such a request, please treat it as suspicious.

2. Identity Theft

What It Is: Identity theft occurs when someone unlawfully obtains your personal information (like your Social Security number or bank account details) and uses it for fraudulent purposes.

How to Avoid It:

- Use Strong Passwords: Create complex passwords for your accounts and change them regularly.

- Monitor Your Accounts: Regularly review your bank statements and credit reports for any unauthorized transactions or accounts.

- Limit Personal Information: Be cautious about sharing personal information online, especially on social media.

Federal law allows you to:

- Get a free copy of your credit report every 12 months from each credit reporting company.

- Ensure that the information on all of your credit reports is correct and up to date.

3. Advance Fee Scams

What It Is: In an advance fee scam, you’re promised a large sum of money (like a lottery win or inheritance) but are asked to pay a fee upfront to release the funds.

How to Avoid It:

- Skepticism is Key: If it sounds too good to be true, it probably is. Always approach offers with skepticism.

- Research Before Responding: Look up the organization or individual making the offer to ensure legitimacy.

- Never Pay Upfront Fees: Legitimate businesses won’t ask for money upfront to access your winnings or funds.

4. Credit Card Fraud

What It Is: Credit card fraud occurs when someone uses your credit card information without your permission to make unauthorized purchases.

How to Avoid It:

- Use Alerts: Set up alerts for transactions on your credit and debit cards. This way, you’ll be notified of any unauthorized activity.

- Review Statements: Regularly check your credit card statements and report any suspicious transactions immediately.

- Use Secure Websites: When shopping online, ensure the site is secure (look for “https://” in the URL).

5. Romance Scams

What It Is: In romance scams, fraudsters build a fake online relationship and eventually request money for various reasons, such as travel expenses or medical bills.

How to Avoid It:

- Take Your Time: Be cautious about forming online relationships too quickly. Scammers often rush intimacy to gain trust.

- Verify Identities: Conduct video calls or use reverse image searches to confirm that the person is who they claim to be.

- Never Send Money: Avoid sending money or personal information to someone you’ve never met in person.

6. Grandchild Impersonation Scams

What It Is: In these scams, fraudsters pose as a grandchild or other family member in distress, claiming to need urgent financial help. They often fabricate stories about accidents, legal troubles, or emergencies to elicit sympathy and urgency.

How to Avoid It:

- Verify the Situation: If you receive a call from someone claiming to be a family member in trouble, hang up and verify the story with another family member or through known contact information.

- Don’t Share Personal Information: Avoid providing any personal or financial information over the phone, especially if the call was unsolicited.

- Consider Using a Code Word: Establish a family code word that only your relatives would know, to verify identities in these types of situations.

7. Investment Scams

What It Is: Investment scams promise high returns with little risk. Scammers often use persuasive tactics to convince you to invest in fraudulent ventures.

How to Avoid It:

- Research Investments Thoroughly: Before investing, research the opportunity and the individuals involved.

- Be Wary of Pressure Tactics: Legitimate investment opportunities won’t pressure you to act quickly.

- Consult Financial Advisors: If in doubt, seek advice from a trusted financial advisor before making any investment decisions.

8. Crypto Scams

What It Is: As cryptocurrencies gain popularity, so do scams related to them. Common crypto scams include fraudulent initial coin offerings (ICOs), fake exchanges, and phishing schemes designed to steal your digital wallet credentials.

How to Avoid It:

- Research Thoroughly: Always research any cryptocurrency investment opportunity or exchange before committing funds.

- Use Reputable Platforms: Stick to well-known exchanges and platforms that have strong security measures in place.

- Beware of Unsolicited Offers: Be cautious of unsolicited messages or advertisements promising guaranteed returns on cryptocurrency investments.

9. Tax and IRS Scams

What It Is: Tax scams often involve scammers impersonating IRS agents, claiming you owe back taxes or penalties and demanding immediate payment. They may also offer fake tax refunds to entice you to share personal information.

How to Avoid It:

- Verify IRS Communications: The IRS will not initiate contact via email or phone without prior notice. Always verify any communication by checking the IRS website or calling their official number.

- Don’t Provide Personal Information: Never share your Social Security number or bank information over the phone unless you initiated the call and are sure of the recipient’s identity.

- Report Suspicious Activity: If you receive a suspicious communication claiming to be from the IRS, report it to the IRS or the Treasury Inspector General for Tax Administration.

Contact us if you suspect fraud

Awareness is your best defense against financial fraud. By understanding these common scams and implementing proactive measures, you can significantly reduce your risk.

At Community First Credit Union, we are committed to keeping your financial well-being secure. If you suspect you’ve been a victim of fraud or have questions about your accounts, please contact us immediately.

Stay informed, stay vigilant, and let’s work together to protect your financial future!