Report a Lost or Stolen Visa Credit Card

Call 800-252-0036

Visa Platinum or Visa Gold

Experience More with a Community First Credit Union Visa Platinum or Gold Card!

Whether you’re exploring new destinations, dining out, or shopping for your favorite brands online, a Community First Credit Union Visa Platinum or Gold card enhances every moment. Accepted worldwide wherever the Visa emblem is displayed, our cards offer the convenience and security you need, no matter where life takes you.

Visa Platinum: Earn Rewards with Every Purchase

With the Community First Visa Platinum card, your everyday purchases are more rewarding. Every time you use your card, you earn valuable Bonus Points that can be redeemed for a wide variety of brand-name merchant gift cards through uChoose Rewards. Visit the uChoose Rewards website and discover an array of gift card options waiting for you. It’s simple: earn points, redeem rewards, and enjoy!

Visa Platinum Card Benefits:

- No Annual Fee

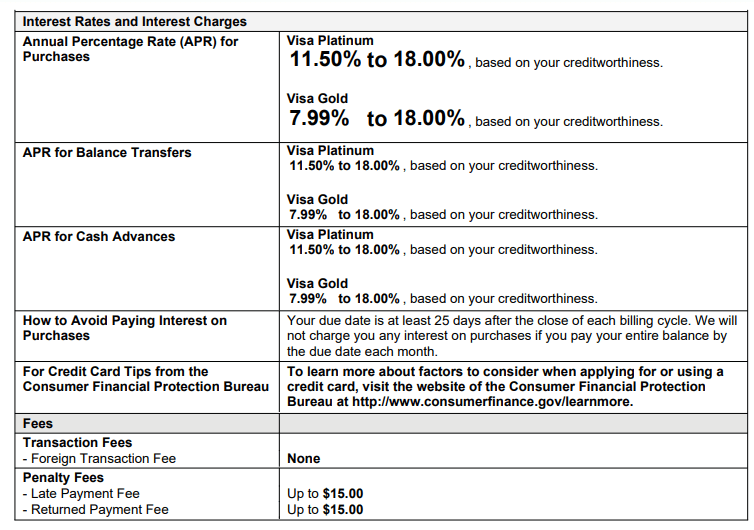

- Rates as low as 11.50% APR

- 25-Day Grace Period

- uChoose Rewards

Visa Gold: Enjoy Even Lower Rates

If you’re looking for an even lower rate, our Visa Gold card is the perfect choice. While it doesn’t include rewards points, it still offers all the essential benefits you need for a great credit card experience.

Visa Gold Card Benefits:

- No Annual Fee

- Rates as low as 7.99% APR

- 25-Day Grace Period

Ready to make the most of your spending? Visit us at any Community First branch to pick up an application, and make our Visa card your go-to for all your shopping, dining, and travel needs. With instant credit at your fingertips, the world is yours to explore!

How We Will Calculate Your Balance: We use a method called “average daily balance (including new purchases).

See the Visa Card Disclosure below or click here for a PDF version.

Verified by Visa adds an extra layer of security to make it harder for someone else to use your Visa card to shop online in the unfortunate event your Visa card or account number is lost or stolen.

Each time your Visa credit or debit card is presented to make an online purchase at a participating merchant, know that Verified by Visa is working to make sure it is you that is attempting to make that purchase and not someone else. There is no special software to install. You will continue to shop as usual, and your enrolled Visa card number will be automatically recognized at checkout.

Visa Gold and Platinum

APPLICATION AND SOLICITATION DISCLOSURE

How We Will Calculate Your Balance: We use a method called “average daily balance (including new purchases).”

Effective Date: The information about the costs of the card described in this application is accurate as of: December 1, 2018. This information may have changed after that date. To find out what may have changed, contact the Credit Union.

Missouri Fee Notice: Credit card fees are governed by §408.140 of the Missouri Revised Statutes. For California Borrowers, the Visa Platinum and Visa Gold are secured credit cards. Credit extended under this credit card account is secured by various personal property and money including, but not limited to: (a) any goods you purchase with this account, (b) any shares you specifically pledge as collateral for this account on a separate Pledge of Shares, (c) all shares you have in any individual or joint account with the Credit Union excluding shares in an Individual Retirement Account or in any other account that would lose special tax treatment under state or federal law, and (d) collateral securing other loans you have with the Credit Union excluding dwellings. Notwithstanding the foregoing, you acknowledge and agree that during any periods when you are a covered borrower under the Military Lending Act your credit card will be secured by any specific Pledge of Shares you grant us but will not be secured by all shares you have in any individual or joint account with the Credit Union. For clarity, you will not be deemed a covered borrower if: (i) you establish your credit card account when you are not a covered borrower; or (ii) you cease to be a covered borrower.

Other Fees & Disclosures: The following fees do not apply to borrowers in the State of Missouri: Account Set-up Fee, Program Fee, Participation Fee, Additional Card Fee, Application Fee, Balance Transfer Fee, Transaction Fee for Purchases, Foreign Transaction Fee, Over-the-Credit Limit Fee, Statement Copy Fee, Document Copy Fee, Rush Fee, Emergency Card Replacement Fee, PIN Replacement Fee, Card Replacement Fee, Unreturned Card Fee, and Pay-by-Phone Fee.

Late Payment Fee: $15.00 or the amount of the required minimum payment, whichever is less, if you are 10 or more days late in making a payment.

Returned Payment Fee: $15.00 or the amount of the required minimum payment, whichever is less.

Card Replacement Fee: $10.00.

Pay-by-Phone Fee: $10.00.

PIN Replacement Fee: $3.00.

Rush Fee: $30.00.

Statement Copy Fee: $5.00.